Thailand Manufacturing: Benefits, Challenges & Future Trends

- Date:

- Author: SVI Content Team

- Share:

Thailand’s economic structure is diversified, in addition to tourism, the manufacturing industry occupies a key position in the country’s economy and relies on unique advantages to become the core driving force to promote economic growth and industrial upgrading.

From cars to electronics to food processing, manufacturing in Thailand has made the country a go-to for global production. Yet, challenges such as factory closures, labor shortages, and global economic uncertainty persist.

To make a better decision on sourcing and manufacturing in this country, learning the best about Thailand manufacturing is critical. This blog will explore the current state of the manufacturing industry, discuss the advantages and challenges of it and tell you about the potential opportunities.

Part 1. Overview of Thailand Manufacturing Industry

The manufacturing industry has been the core of Thailand’s development. So far in 2024, the manufacturing sector contributes 26% to Thailand’s GDP, with automotive production alone accounting for 11% of industrial output. As the second largest automobile producer and exporter in Southeast Asia, Thailand has long been known as the “Detroit of Asia” and is an important global automobile manufacturing and export base.

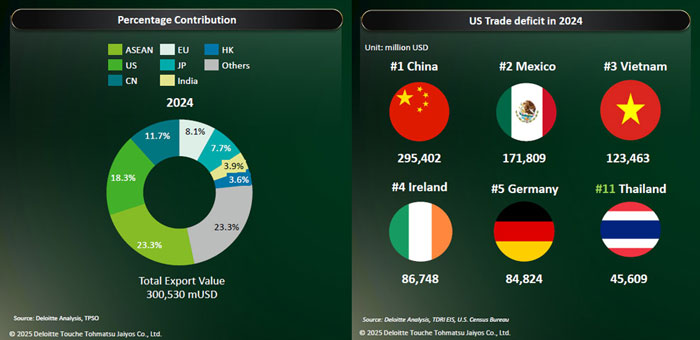

In 2024, overall export grew by 5.4% year-on-year, with ASEAN, the U.S., and China as top markets. Also, Thailand is the 11th country with the largest trade surplus with the U.S. at USD$ 45.6 billion, more than double that in 2018 when the US-China trade war began, based on the U.S. Census Bureau.

What Are the Main Industries in Thailand?

We know that the manufacturing sector plays an important part, and 80% of made-in-Thailand products contribute to the export value. According to data from Deloitte, the top 10 exports for 2024 in terms of value are:

- Electric Equipment

- Automobile, Equipment and Parts

- Electrical Appliance

- Jewelry and Ornaments

- Rubber Products

- Plastics Material

- Construction Materials

- Machinery and Equipment

- Chemical

- Textile

What Are the Industrial Regions in Thailand?

Area 1. Eastern Economic Corridor (EEC)

The Eastern Economic Corridor (EEC) is Thailand’s core project to attract foreign investment, the project is planned in the eastern coast of Thailand, Chachoengsao, Chonburi and Rayong 3 provinces, vigorously develop infrastructure, the implementation of a series of investment preferential policies to encourage the development of high value-added industries, similar to China’s special economic zones.

Location: Chonburi, Rayong, and Chachoengsao provinces.

Specialization: automotive, electronics, petrochemicals

Significance:

- Accounts for 78.18% of Thailand’s industrial estate area.

- Benefits from robust transport networks like Laem Chabang Port and U-Tapao Airport.

- Key driver for Thailand’s position as a regional manufacturing hub.

Area 2. Bangkok & Surrounding Provinces

Bangkok, Thailand’s capital, and nearby provinces form the core industrial belt of the country.

This area is known for its well-established infrastructure, dense concentration of manufacturing zones, and excellent connectivity to Suvarnabhumi Airport and major ports like Laem Chabang. It’s also close to the EEC, which begins just east of this region, benefiting from the high-tech facilities for manufacturers.

Location: Bangkok, Samut Prakan, Pathum Thani, Samut Sakhon, Nonthaburi, Nakhon Pathom

Specialization: electronics and electrical appliances, automotive parts

Significance:

- Over 800 factories in Bangkok alone produce telecommunication equipment, semiconductors, and computer parts.

- The region is a logistics hub with proximity to Suvarnabhumi Airport.

- Contributes significantly to export-driven industries such as electronics.

Part 2. What Are the Benefits of Manufacturing in Thailand

Thailand’s manufacturing sector offers several advantages that make it a competitive destination for global businesses. Here are some key benefits:

1. Strategic Location in Southeast Asia

Thailand is located in Southeast Asia, with the Gulf of Thailand to the east and the Andaman Sea to the west. It has benefits from its strategic location at the crossroads of regional and global trade routes, as it can easily access markets like China, India, and ASEAN countries. With its central position in ASEAN, the country can benefit from many free trade agreements and the “China+1” strategy.

2. Established Supply Chain

Thailand has built a mature industrial ecosystem with a well-established supply chain. It has been supported by abundant raw materials (e.g., rubber), strategic industrial regions like the EEC, and advanced logistics infrastructure. Besides, its extensive network of suppliers and service providers facilitate efficient production processes and timely delivery of goods.

3. Cost-Effective Labor Costs

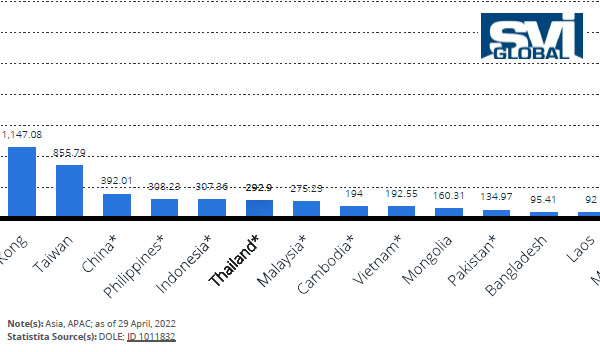

The labor costs in Thailand offer a balance of affordability and quality among the country in Asia. Thailand’s minimum wage varies by province. As of Apr 3, 2025, the minimum daily wage ranges from 337 to 400 Thai Baht (USD$ 9.83 – 11.67) per day. While, according to statistics from APAC, we know that the minimum monthly wage of Thailand is about USD$ 292.2, lower than China, Philippines, and Indonesia.

4. Government Support and Incentives

The government actively promotes foreign investment through various incentives, including tax reductions, lower import tariffs on equipment, and expedited permits and licensing processes. Initiatives like the Eastern Economic Corridor (EEC) are a good example that offers multiple benefits, such as corporate income tax exemptions, import duty exemptions, and personal income tax reduction.

5. Highly Developed Infrastructure

The country has built and invested in advanced infrastructure that improves supply chain efficiency while reducing costs and carbon emissions.

Over 80% of domestic goods are transported via its extensive highway network between industrial zones with ports and neighboring countries. While major ports like Bangkok, Laem Chabang and Map Ta Phut and airports like Utapao Airport connect Thailand to global shipping routes.

Part 3. What Challenges Do Thailand Manufacturing Face

Like many manufacturing hubs, Thailand can’t avoid the challenges in the supply chain. And the following is what you can consider about it.

1. Low Competitive Labor Costs in Southeast Asia

Compared with wages in China, a big manufacturing country, Thailand’s monthly salary is more cost-effective. However, the current manufacturing transfer focuses on Southeast Asian countries, including Vietnam, Indonesia, Malaysia, the Philippines and other countries also have a certain manufacturing base and capacity.

The minimum monthly salary in Thailand is about $292.2, while the wages in Malaysia, Cambodia and Vietnam are lower than that in the country, so the labor cost in Thailand is not an absolute advantage.

2. Factory Closures

According to Bangkok news, over the past two years, an average of 50 factories (electronics, automotive, steel, garment industries) per month have shut down due to rising costs, weak consumer spending, and competition from cheaper imports (e.g., Chinese steel).

Thailand’s Manufacturing Production Index (MPI) has experienced fluctuations in recent years. In 2024, the MPI contracted by 1.79% year-on-year, primarily due to a slowdown in the automotive industry and increased imports affecting local manufacturers. Specifically, December 2024 saw a 2.11% year-on-year drop in the MPI, marking the 17th consecutive month of contraction.

3. Lack of High-Skilled Workforce

Manufacturers in Thailand are experiencing difficulties in finding adequately skilled labor in robotics, automation, and precision engineering, which hampers productivity and innovation. This skills gap is partly due to an aging population and insufficient emphasis on technical education and vocational training.

4. Intense Regional Competition

Thailand faces stiff competition from neighboring countries that offer more attractive incentives to foreign investors.

China’s manufacturing industry, with its price advantages and technological upgrades, has squeezed Thailand’s market share in electronics, machinery and other fields. Nations like Vietnam and Indonesia have implemented favorable policies and developed robust infrastructure to draw investment away from Thailand.

At the same time, the trade war in the United States may lead to a slowdown in Thailand’s exports to the U.S. (such as electronic components, photovoltaic products) and intensify international competition.

Part 4. Future of Manufacturing in Thailand

1. Smart Manufacturing & Industry 4.0

To make manufacturing more innovative and promote digital transformation with the growth of smart manufacturing, the Thai government actively supports this transition through initiatives like the “Industry 4.0” strategy.

The Thailand manufacturers are increasingly adopting smart technologies such as automation, artificial intelligence (AI), and the Internet of Things (IoT) across supply chains. These innovations enhance productivity, reduce operational costs, and most importantly, improve product quality.

2. Supply Chain Diversification

Geopolitical uncertainties and disruptions in the global urged many companies to diversify their supply chains. Thailand’s strategic location in Southeast Asia, established infrastructure and supportive government policies make it an attractive destination for businesses aiming to seek alternatives for their supply chains. So far, the country has experienced an influx of factories relocating from the main manufacturing hubs. To capitalize on this trend, Thailand is now boosting its industrial capabilities to grow and stabilize this benefit.

3. Expanding Export Markets

Thailand’s manufacturing sector is poised for growth in export markets, supported by strategic government initiatives and global economic trends.

Exports currently account for 60% of Thailand’s GDP, with manufacturing playing a central role in driving this growth. In 2024, Thailand’s total export value reached US$300 billion, marking a 5.4% year-on-year increase.

The country has strengthened exports to key markets such as the United States (+12.5%), India (+16%), and the European Union (+11%) in 2024. Exports to ASEAN countries remain significant, contributing over 23% of total export value.

The trend for Thailand’s expanding exports is still promising, as the country is actively reducing dependency on traditional markets like China by expanding into emerging regions. This can mitigate risks associated with over-reliance on specific markets and enhance resilience against global economic fluctuations.

Conclusion

Thailand has held a strong position in global manufacturing—and it’s gaining momentum as global dynamics shift. The geographic location is not its only advantage, the support of government-backed policies and robust infrastructure has laid the foundation for it to become one of the manufacturing alternatives in the evolving industrial landscape.

In this blog, we’ve shown the key factors driving Thailand’s rise as an attractive hub and what challenges it must overcome during the transformation. With the global trend toward supply chain diversification, Thailand manufacturing is well-positioned to capitalize on new opportunities.

If you’re considering new sourcing destinations, Thailand can be your solid choice. At SVI Global, we recognize the country’s potential and have positioned our team nearby to help you connect easily with reliable suppliers. Let us help you unlock the benefits of manufacturing in Thailand.