A Comparative Analysis of Manufacturing in Mexico vs China

- Date:

- Author: SVI Content Team

- Share:

Manufacturing is a vital component of global economic activity, and countries like Mexico and China have emerged as major players in the industry. With their significant manufacturing capabilities, these countries attract businesses seeking cost-effective production, access to large consumer markets, and favorable trade agreements. However, when it comes to manufacturing in China vs Mexico, which is the wise choice for you?

Here’s an overview and comparison of manufacturing in Mexico and China, showing the different advantages between these two countries by examining factors such as labor cost, trade agreements, and delivery time. With this analysis, businesses can make informed decisions about where to establish their manufacturing operations.

Part 1. Overview of Manufacturing in Mexico and China

What Makes China an Advantaged Country in Manufacturing?

China has been the global leader in manufacturing for decades, consistently attracting a significant influx of business investments. This begs the question: What factors contribute to China’s popularity as a manufacturing hub?

Strengths of manufacturing in China:

- Large labor force

- Cost advantages

- Established infrastructure

- Extensive supply chain networks

- Technological capabilities and innovation

How Did Mexico Emerge as a Rising Manufacturing Nation?

Mexico has experienced remarkable growth as a rising manufacturing hub, as evidenced by the latest statistics revealing its position as the top trading partner of the United States in 2023. The total trade value of $798.83 billion not only broke the previous record set with Canada just a year prior but also highlights Mexico’s growing importance in the manufacturing sector. What’s the opportunity from Mexico?

Strengths of manufacturing in Mexico:

- Proximity to the United States market

- Skilled and cost-effective labor

- Favorable trade agreements

- Reliable industries in automotive, aerospace, etc.

Part 2. What Factors to Be Considered When Comparing Mexico vs China Manufacturing

The manufacturing prowess of China, often hailed as the world’s factory, has been undeniable. However, the world trade landscape is in a state of flux. A new player has emerged on the stage of manufacturing, and it’s none other than Mexico, strategically located close to the United States.

The industrial situation in both countries merits careful consideration when deciding whether to move manufacturing from China to Mexico. Let’s delve into some crucial factors that can help guide this decision-making process.

1. Prominent Industries

- Electronics and Telecommunications

- Automotive

- Textiles and Apparel

- Machinery & Equipment

Mexico’s manufacturing sector is also very involved in a wide range of industries, including automotive, aerospace, electronics, medical devices, and more. Among them, the most remarkable is the automotive industry. Mexico is a major automobile manufacturer, where 89 of the world’s top 100 auto parts producers are located. The country’s automotive prowess has attracted the attention of major industry leaders, including Elon Musk. In a groundbreaking move, Musk announced his plans in 2023 to invest a staggering $5 billion in Mexico. This investment aims to establish the “largest electric vehicle factory in the world,” surpassing the size of Tesla’s renowned Shanghai facility by up to 20 times. The allure of Mexico’s automotive sector is not confined to Musk and Tesla alone. Even notable Chinese companies such as BYD, Chery, and SAIC are actively exploring expansion opportunities in Mexico. Salient industries in Mexico:

- Automotive

- Aerospace and Aviation

- Electronics

- Medical Devices

2. Cost Factors

Cost considerations take center stage in choosing the country to develop its manufacturing operations. Companies must carefully analyze various cost factors, including labor, energy, tariffs, and taxes.

China, once renowned for its exceptionally low labor costs, has experienced a notable shift in recent years. As China’s manufacturing industry has gained momentum, the cost of labor has been increasing over time. According to recent data reports, the minimum monthly wages in China reached around $392 in 2022. Moreover, China’s energy costs and tariffs have also risen, driven by stricter environmental policies and the dynamics of the U.S.-China relationship. These factors have made manufacturing in China less appealing for companies exporting their products to the U.S.

Enter Mexico, where labor costs present a more attractive proposition. In 2022, the Mexican government announced a minimum wage for workers of approximately $8.25 per day, and the data report revealed monthly minimum wages are around $256. And thanks to the Mexican Government’s policy of providing various incentives, such as tax breaks and low-cost loans. These policies have provided strong support for the development of the manufacturing sector in Mexico.

As a result, when it comes to the cost of labor in Mexico vs China, Mexico is the clear victor over China for recent years.

More info:

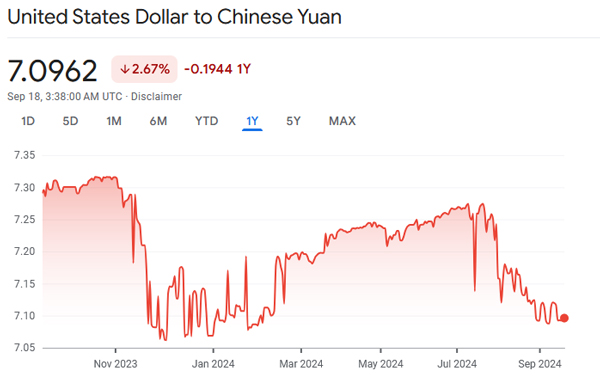

It is essential to know about exchange rates as fluctuations can directly impact the cost of production and export competitiveness. Here is it!

The latest exchange rate of USD/CNY.

The latest exchange rate of USD/MXN.

3. Labor Force

China, one of the world’s most populous countries, holds a population of about 1.43 billion in 2023.

It is dominant in numbers when it comes to its labor force. In 2022, China’s labor force amounted to an impressive 768.6 million, making it a force to be reckoned with. However, it’s important to note that China is witnessing a declining trend in its labor force, a pattern expected to persist due to a shrinking working-age population and a decreasing labor market participation rate.

In contrast, Mexico, with a population estimated at 130 million in 2023, demonstrates a different labor force dynamic. In 2022, Mexico’s labor force stood at around 58.7 million people, indicating a general upward trend in recent years. This growth trajectory positions Mexico as a country with potential for a steadily expanding labor force in the manufacturing sector.

Comparing China vs Mexico labor rate, China currently holds the upper hand with a labor rate of approximately 53%, while Mexico’s labor rate stands at around 46%. However, the evolving trends in both countries should not be overlooked. China’s declining labor force and Mexico’s increasing labor force suggest a shifting landscape that could impact future manufacturing considerations.

4. Trade Agreements & Policy

In the evolving global industrial supply chain picture, a noteworthy strategy has emerged: the “Excluding China” strategy led by the United States. Interestingly, this strategy has made neighboring Mexico an important beneficiary in recent years.

Several key developments have contributed to Mexico’s rise. For example:

◼ The signing of the United States-Mexico-Canada Agreement (USMCA) in 2020.

This landmark agreement not only accelerated the process of “nearshore outsourcing” within the U.S. but also granted duty-free access to the expansive North American market.

- The U.S. government’s implementation of the CHIPS and Science Act in 2022 further reinforced this trend. By imposing strict export controls on computer chips, the act limits China’s advanced manufacturing.

- In 2023, Biden signed an executive order restricting some U.S. investment in China’s high-tech industries.

- Moreover, the U.S. government began imposing tariffs of 25% on Chinese imports in 2018, a measure that remains in place today.

This set of policies and tariff impositions creates a clear advantage for Mexico, and by strategically investing in Mexican factories, companies can bypass these additional tariffs, reduce overall manufacturing costs, and gain a competitive advantage when entering the U.S. market.

5. Productivity

China, renowned for its well-established supply chains and comprehensive transportation infrastructure, stands as a symbol of large-scale production capabilities and operational efficiency. Its large population and extensive industrial infrastructure facilitate its overall productivity. And with a focus on shifting from low-end to high-end manufacturing, China is investing in automation, robotics, and cutting-edge digital technologies to revolutionize its manufacturing sector and take productivity to new levels.

Meanwhile, concentrated primarily in low-value-added, labor-intensive industries, Mexico’s supply chain network may not rival China’s in terms of scale and complexity. There are some areas where infrastructure development lags, posing challenges to Mexico’s overall productivity growth.

While it may not boast the same vast infrastructure as China, Mexico’s manufacturing sector has gone through a notable transformation. Collaborating with its North American neighbors and leveraging favorable trade agreements, Mexico is repositioning itself as a major player in industries such as automotive, electronics and aerospace.

6. Shipping

When it comes to the efficient delivery of goods between China vs Mexico, the geographic advantage of Mexico for manufacturers targeting the North American market cannot be overstated. With its proximity to the United States, Mexico offers a logistical dream come true. The delivery time of goods from Mexico is remarkably shorter compared to China. This advantage is amplified by Mexico’s strategic positioning, bordered by the Atlantic and Pacific Oceans, which grants easy access to numerous seaports, facilitating seamless trade with North America and Europe.

Imagine the possibilities of shipping from Mexico to the USA, where goods can reach their destination in a mere 1 – 3 days. This swift delivery timeframe allows manufacturers to meet tight deadlines, reduce inventory costs, and provide outstanding service to their customers.

On the other hand, China, with its expansive territory, boasts a well-developed transportation system encompassing an extensive network of seaports and airports. However, due to the considerable distance to the USA, shipping products from China to the destination poses challenges both in cost and time.

To expedite shipments from China to the U.S., the fastest option is often air freight or courier services. While these methods offer speed, they come at a higher cost, affecting the overall profitability of businesses. Balancing the need for timely deliveries with cost efficiency is a delicate issue for manufacturers operating in this context.

For more details, visit the page: What Is the Best Way to Ship Products from China to the USA.

7. Communication

Effective communication plays a pivotal role in global business, and the contrasting time zones between China and the U.S. present a unique challenge. China’s time zone is 13 hours ahead of the U.S. Eastern Time, and organizations must navigate this time difference to ensure that meetings and conversations are seamless. Furthermore, the linguistic and cultural disparities between China and America add an extra layer of complexity, making effective communication a captivating puzzle to solve.

On the other hand, Mexico is only one hour behind Eastern Standard Time, which provides more favorable conditions for communication. This time proximity eases the coordination of meetings and facilitates real-time interactions between Mexican and American counterparts, fostering smoother collaboration. Mexico’s official language is Spanish, but interestingly, unlike Chinese, which is ideograph, Spanish is just as phonological as English, and coupled with the interest in learning Spanish in the USA, the linguistic compatibility makes Mexico an option for businesses seeking effective communication

8. Intellectual Property Protection

Safeguarding intellectual property (IP) is of paramount importance in startups and manufacturing companies, whether you’re outsourcing your operations or setting up your own factories.

With the entry into force of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the USMCA in Mexico, the Mexican intellectual property system has been revised. It has made efforts to strengthen intellectual property protection, including aligning its laws with international standards and participating in international treaties.

Intellectual property protection in China has been a longstanding concern for many businesses due to past challenges. However, the Chinese government has taken steps to improve IP protection and enforcement.

In 2020, the United States and China embarked on a Phase One trade deal, marking a significant milestone in their complex economic relationship. The agreement addressed several structural issues related to intellectual property protection, forced technology transfer, currency manipulation, and market access barriers. China pledged to improve its IP protection framework, strengthen enforcement mechanisms, and take measures to prevent the forced transfer of technology from foreign companies.

Part 3. Comparison Tablet of Manufacturing in China vs Mexico

| Category | China | Mexico |

|---|---|---|

| Population | 1.43 billion | 130 million |

| Labor Force | 768.6 million | 58.7 million |

| Labor Rate | 53% | 46% |

| Labor Costs | Minimum monthly wages in 2022 are about $392 | Minimum monthly wages in 2022 are about $256 |

| Geographical Location | Located in East Asia, bounded by the Pacific Ocean to the east and the Indian Ocean to the southwest | Located in southern North America, neighboring the United States to the north and bordering the Pacific and Atlantic Oceans |

| Shipping Time to US | More than 20 days by ocean | 1 to 3 days by road |

| Prominent Industries |

Among the diverse industries in China, which excel: ✔ Electronics and Telecommunications ✔ Automotive ✔ Textiles and Apparel ✔ Machinery & Equipment |

✔ Automotive ✔ Aerospace and Aviation ✔ Electronics ✔ Medical Devices |

| Trade Agreements & Policy | Phase One trade agreement | The United States-Mexico-Canada Agreement (USMCA) |

| Productivity | Quick | Slower than China |

| Infrastructure | Sophisticated and mature | Less developed |

| Intellectual Property Protection | Improving its IP protection framework | Well-founded and strengthened |

| Language | Chinese | Spanish |

| Time Zone | 13 hours ahead | 1 hour behind |

Part 4. Conclusion

The trend of moving manufacturing from China to Mexico has gained attention. We’ve thoroughly developed the blog about manufacturing in China vs Mexico, and specified the aspects like labor cost and geopolitical considerations that companies should research before outsourcing Mexico vs China.

Whether it’s the strategic proximity to the United States and favorable trade agreements in Mexico or the well-established manufacturing infrastructure and vast consumer market in China, both countries have distinct advantages for manufacturing.

Yet, amidst this dazzling array of choices, one truth remains resolute: relying solely on a single country’s supply chain can be akin to walking a tightrope without a safety net. The changing tides of global manufacturing compel businesses to tread wisely and explore new horizons. To keep pace with the trend, SVI Global has strategically established offices in both Mexico and China. We can swiftly extend our support to customers seeking sourcing solutions or supply chain management.