Outsourcing to Mexico Is Trending

- Date:

- Author: SVI Content Team

- Share:

In today’s fast-paced global market, companies are always on the lookout for efficient and cost-effective sourcing solutions to keep the supply chain strong and flexible. Mexico is quickly becoming a hotspot for global sourcing, attracting more and more companies. If you’re considering outsourcing to Mexico, this article is here to guide you.

We’ll walk you through the advantages and disadvantages, highlight key industrial sectors and manufacturing areas, and share important tips for doing business there. Let’s dive in and explore how sourcing from Mexico can benefit your operations!

Part 1. Why Does Mexico Emerge as a Popular Outsourcing Destination

Enter Mexico, a country that has been steadily gaining traction as a preferred sourcing destination for many businesses. This is driven by a confluence of global trends.

1) Shifting Global Manufacturing Landscape: The risk of dependence on a single source is becoming conscious by the public. This concern prompts companies to diversify their supply chains. Mexico, with its proximity to the US and Canada, became an attractive alternative.

2) Rising Labor Costs in Asia: As labor costs in China and other Asian manufacturing hubs increased, companies sought more cost-effective options. Mexico offers a balance between labor costs and a skilled workforce compared to its Asian counterparts.

3) Trade Agreements: The USMCA (United States-Mexico-Canada Agreement), a successor to NAFTA, facilitated smoother trade flows and reduced tariffs between the three countries, making Mexico even more appealing for businesses in North America.

4) Focus on Nearshoring: The concept of “nearshoring” gained traction, emphasizing the benefits of sourcing from geographically closer locations for better control, faster delivery, and reduced transportation costs. Mexico, being a neighbor to the US, perfectly fits this trend.

5) Growing Domestic Demand: Mexico’s own growing middle class and expanding economy fueled demand for goods and services, creating a favorable environment for manufacturing and outsourcing.

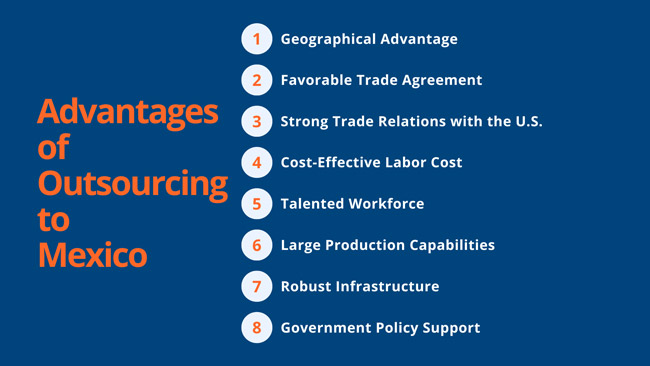

Part 2. Advantages of Outsourcing to Mexico

Mexico’s rise as a preferred sourcing destination isn’t merely by chance. The country offers a plethora of advantages that make it an attractive option for businesses aiming to optimize their supply chains. Here’s a closer look at the key benefits:

1. Geographical Advantage

Mexico’s strategic geographical location, right next to the U.S. and close to Canada gives it the superiority that other don’t have.

The proximity means reduced shipping times and freight rates for companies. It also works as a charm for companies who want factory visit, real-time collaboration, and quicker adjustment to market demands.

2. Favorable Trade Agreement

One of the most significant advantages of sourcing from Mexico is the favorable trade environment. Mexico is one of the most open economies worldwide. It has 13 Free Trade Agreements (FTAs) with 50 countries, offering businesses access to a vast market and tariff-free exports to multiple destinations.

Besides, it is a signatory to the United States-Mexico-Canada Agreement (USMCA), which has made Mexico the gateway to the most important market in the world, the North American market.

3. Strong Trade Relations with the U.S.

Mexico’s trade relationship with the U.S. is not just about proximity. Over the years, both countries have developed a symbiotic trade relationship, with goods and components often crossing borders multiple times before a final product is assembled.

According to the data released by the U.S. Department of Commerce in 2023, for the first time in more than 20 years, Mexico surpassed China as the largest source of U.S. imports.

4. Cost-Effective Labor Cost

According to the statistics, Mexico, with a population of approximately 128 million in 2023, ranks as the 10th most populous country in the world. This provides an abundant labor pool, particularly with a young workforce where individuals aged 15-64 comprise about 67% of the population. This demographic advantage ensures a steady supply of labor for manufacturing needs.

Compared to China, the world’s largest manufacturing hub, Mexico offers competitive labor costs. As of 2022, the average wage in Mexico’s manufacturing sector is around $480/month, while China’s is $840/month.

5. Talented Workforce

Costs and workforce in Mexico are competitive. Mexico’s educational system and training programs have produced a workforce that’s skilled in various manufacturing sectors. Many universities and technical institutes in Mexico offer specialized programs that align with the needs of industries, equipping graduates with relevant technical skills.

Whether it’s electronics, automotive components, or textiles, companies can tap into a pool of talented individuals ready to deliver quality work.

6. Large Production Capabilities

Mexico’s large production capabilities are a significant advantage for businesses considering outsourcing. The country has invested in a robust manufacturing infrastructure, including industrial parks, specialized zones, and advanced production facilities.

This infrastructure supports efficient and scalable production, allowing companies to meet high-volume manufacturing requirements.

7. Robust Infrastructure

Over the past few decades, Mexico has invested heavily in developing its infrastructure, from ports to roads to telecommunications. The robust infrastructure in Mexico enables timely delivery of goods and services and overall operational efficiency.

8. Government Policy Support

The Mexican government has implemented various initiatives to attract foreign investment and promote outsourcing. These include tax incentives, streamlined regulations, and support for business development. The support from the government makes it an ideal country for companies outsourcing manufacturing in Mexico.

Part 3. Challenges of Sourcing in Mexico

While Mexico offers a myriad of benefits for sourcing, it’s essential for you to be aware of the challenges that might arise in the process. Understanding these challenges can help you strategize effectively and mitigate potential risks. Here are some of the primary concerns:

1. Legal and Regulatory Environment

The legal and regulatory environment in Mexico can be complex for the first time. From understanding import-export regulations to ensuring compliance with local manufacturing standards, you need to be well-versed in the legal framework to avoid potential pitfalls.

2. Cultural and Language Barriers

While many professionals in Mexico are proficient in English, language barriers can still exist, particularly among certain segments of the workforce. Miscommunication, misunderstandings, and ineffective communication can arise if language differences are not adequately addressed.

You can consider investing in clear communication and perhaps even hiring bilingual intermediaries to bridge any gaps.

3. Supply Chain and Procurement Issues

One significant challenge you might face is the lack of a mature supply chain for certain products. If you require customized components or products, the lead time can be considerably extended due to the underdeveloped supply chain.

Additionally, many Mexico suppliers, while skilled and efficient, operate on a smaller scale. This means that they might have limited capacity, and when faced with sudden large orders, there’s a risk of not meeting the demand in the desired timeframe.

4. Investment Costs

Setting up operations or transitioning a part of the business to Mexico might involve upfront costs. From scouting locations to setting up facilities or even training local teams, you need to be prepared for these initial expenditures.

5. Security Issues

Certain regions in Mexico may have security and safety concerns, particularly related to criminal activities. If you are considering outsourcing to Mexico, you should carefully assess the security situation in the specific region where you plan to establish operations. Implementing appropriate security measures and working with reliable local partners can help mitigate these challenges.

6. Increasing Minimum Wages

These years, Mexico has attracted considerable foreign direct investment. Large inflows of foreign capital have led to an appreciation of the Mexican currency, the peso, and the appreciation is expected to continue.

Besides, in January 2024, Mexico’s wage commission, Conasami, implemented a 20% rise in minimum wages. The increase boosts the daily minimum pay from 207.44 pesos (US$12) to 248.93 pesos (US$14.22).

Part 4. Key Industrial Sectors for Outsourcing in Mexico

1. Automotive Industry

The automotive industry is the pillar of Mexico’s national economy, and is also the largest sector of the manufacturing industry and the industry with the highest FDI inflows of many well-known automobile manufacturers.

It is the world’s sixth-largest automobile production base, the fourth-largest exporter of light cars and the fifth-largest producer of heavy-duty vehicles.

2. Textiles and Apparel Industry

The textiles and apparel industry, a traditional competitive industry in Mexico, can date back to 1400 BCE, and it is the fourth-largest manufacturing sector in Mexico.

The industrial system of it is sound. According to incomplete statistics, Mexico has about 2800 textile enterprises. USA is Mexico’s most important export market for textile and clothing products, more than 90% of Mexico’s clothing and home textile products are sold to the United States.

3. Electronics and Technology Industry

The electronics sector in Mexico is robust, with significant production of consumer electronics, medical devices, and electronic components. The presence of major multinational electronics companies highlights Mexico’s capabilities in this field.

4. Medical Device Industry

Mexico’s medical device industry has been growing rapidly over recent years and is a major contributor to the country’s exports. According to the Mexican Association of Innovative Medical Devices Industry (AMID), Mexico is the eighth largest exporter of medical devices in the world, the biggest exporter of medical devices in Latin America, and one of the main suppliers of medical devices to the United States.

5. Aviation and Aerospace Industry

The aerospace industry in Mexico covers a wide range of areas, including satellite manufacturing, spacecraft assembly, aero-engine production and so on. Mexico has emerged as one of the major players in the global satellite manufacturing industry, with a market share of about 20%.

Part 5. Key Manufacturing Regions for Sourcing from Mexico

Mexico’s manufacturing prowess is spread across several key regions, each known for its specialization in different industries. Check out the manufacturing hubs and see what you can source products from Mexico.

1. Guanajuato

If you want to source automobile products made in Mexico, Guanajuato is the most ideal industrial areas for you.

Located in central Mexico, Guanajuato is currently the fastest growing manufacturing state in Mexico. It ranks 6th in economic output nationally and is expanding rapidly.

Industry: The most prominent sector is automotive manufacturing. It is the largest automotive OEM cluster in Mexico.

2. Baja California

Located in the northwest of Mexico, Baja California is close to the US border, particularly California, making it an ideal location for companies targeting the US market.

Industry: Baja California is a prominent manufacturing region known for its strong presence in the aerospace, automotive, electronics and medical device industries. Major cities like Tijuana and Mexicali have a strong industrial base with numerous maquiladoras (manufacturing plants).

3. Nuevo León

Nuevo León, particularly its capital, Monterrey, is the third largest city in Mexico and a major industrial and manufacturing center with excellent connectivity to the US. It is home to many international companies and has a strong engineering and technical workforce.

Industry: The region has a well-developed manufacturing ecosystem and is known for industries such as automotive, steel, electronics, and appliances.

4. Puebla

Located in east-central Mexico, Puebla is close to Mexico City. It is Mexico’s fourth-largest city with more than 5 million population. Seaports like the Port of Veracruz and the Port of Manzanillo are well-connected with Puebla through its good transportation network.

Industry: Puebla is a major center for the automotive industry, particularly for German manufacturers like Volkswagen, Honda, BMW. It also has a strong food processing and textile sector.

5. Chihuahua

Located in northern Mexico, Chihuahua shares a border with Texas, providing easy access to the US market. It is convenient to distribute goods throughout the US and Canada.

Industry: This region specializes in electronics, automotive, and aerospace manufacturing. Ciudad Juárez, in particular, has a high concentration of maquiladoras.

Part 6. Key Considerations When Sourcing Manufacturing Companies in Mexico

Sourcing products from Mexico requires a strategic approach. Here are some crucial considerations to keep in mind:

1) Conduct Market Research: Understand Mexico’s strengths and identify the products best suited for sourcing from the region to narrow down potential suppliers and set clear expectations.

2) Engage with Local Experts: Collaborating with local sourcing consultants or agencies who possess knowledge of manufacturing in Mexico.

3) On-site Factory Visits: Physically inspect facilities to assess capabilities, quality control processes, and operational efficiency.

4) Cultural Sensitivity: Understand the importance of relationship-building in Mexican business culture. Fostering genuine relationships to have favorable negotiations and long-term partnerships.

5) Contract Negotiations: Clearly define all terms during contract negotiations and seek legal counsel familiar with Mexican business law to ensure contracts are binding and enforceable.

6) Quality Assurance: Establish clear quality standards and implement regular quality checks and audits to maintain product integrity.

7) Communication: Establish clear channels and frequencies of communication to ensure that both parties are aligned, and any issues are addressed promptly.

8) Risk Management: Have contingency plans in place to address any unforeseen challenges when outsourcing to Mexico.

Final Thoughts

The allure of Mexico as a prime sourcing destination is undeniable. Its proximity to the market in North America, advantageous trade agreements and competitive labor cost beckon businesses to explore the opportunities it presents.

However, the journey of outsourcing to Mexico, while promising, is interspersed with challenges. To have a complete perspective for you, we also show you the challenges of sourcing in Mexico and introduce the key industries and manufacturing areas there.

How to Find Manufacturer in Mexico

As the complexities of global sourcing continue to evolve, having a trusted partner by your side can make all the difference. SVI Global, with its rich experience in sourcing from Mexico, stands ready to guide businesses through this journey.

Our professional team, equipped with local insights and expertise, is adept at navigating the challenges highlighted in this article. We believe in not just addressing the challenges but turning them into opportunities for growth and optimization.

If you’re considering expanding your sourcing activities to Mexico, let SVI Global be your compass. We ensure that your venture into the Mexican manufacturing landscape is both profitable and seamless.